The size of the worldwide automotive electronics market was estimated at USD 244,954.5 million in 2022, and from 2023 to 2030, it is anticipated to increase at a CAGR of 7.9%. Over the projected period, demand for automotive electronics is anticipated to increase due to the increased integration and implementation of modern safety systems including automatic airbags, parking assistance systems, emergency braking, and lane departure warning to reduce traffic accidents. In addition, technologies including alcohol ignition interlocks, emergency call systems, and accident data recorder systems are being quickly adopted to protect passengers inside vehicles and are anticipated to propel market expansion over the projection period.

The market’s growth is impacted by the average price of electronic and software components per vehicle, which is rising significantly. The demand for automotive electronics is being fueled by elements including the integration of IoT and AI into automobiles, the availability of automated vehicles, the desire for in-vehicle safety features, and an increase in the demand for entertainment services.

The growing demand for in-car infotainment systems coupled with in-vehicle data storage owing to their greater comfort, efficiency, and convenience is expected to elevate market growth during the forecast period. The low adoption of automotive electronics in newly industrialised countries, an increase in the cost of the final product as a result of the integration of vehicle electronics, and high maintenance and replacement costs, however, hampers the overall market growth.

Research Methodology:

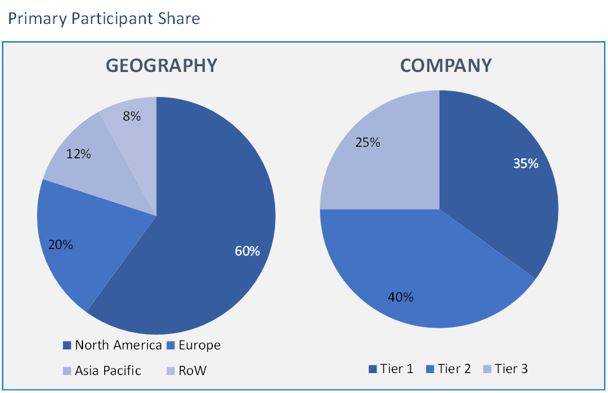

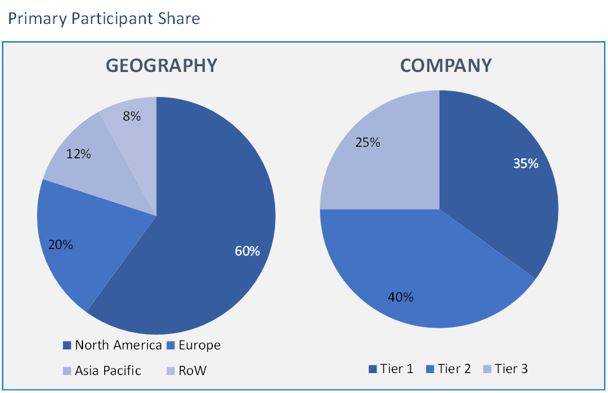

The automotive electronic market has been analyzed by utilizing the optimum combination of secondary sources and in-house methodology and a unique balance of primary insights. The real-time valuation of the market is an integral part of our forecasting and market sizing methodology. Industry experts and our primary participants have helped to compile related aspects with accurate parametric estimations for a complete study. The primary participants share is given below:

Global Automotive Electronic Market based on Component:

- Electronic Control Unit

- Sensors

- Current Carrying Devices

- Others

Global Automotive Electronic Market based on Application:

- ADAS

- Infotainment

- Body Electronics

- Safety Systems

- Powertrain Electronics

Global Automotive Electronic Market based on Sales Channel:

Global Automotive Electronic Market based on Geography:

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe (RoE)

- Asia Pacific (APAC)

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific (RoAPAC)

- Latin America (LATAM)

- Brazil

- Argentina

- Rest of South America

- Middle East and Africa (MEA)

- UAE

- Turkey

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

Due to their high cost and extensive use in automobiles, electronic switches, fuses, connectors, and wiring harnesses account for a sizeable portion of the market for current-carrying devices. The segment’s expansion can also be attributed to consumers’ growing need for connectivity, comfort, and safety features in both passenger cars and commercial vehicles. From 2023 to 2030, the sensors market is anticipated to grow at a CAGR of 7.9%. In the sensors section, there are sensors for detecting physical elements, a vehicle’s proximity and location, chemical properties, and process variables. Governmental initiatives that enhance passenger safety and security are expected to be a major driver of revenue development in a number of countries. These gadgets have developed into an essential part of automobiles because they keep an eye on things like temperature, speed, and tyre pressure and condition while taking preventative action in the event of danger.

In 2022, the safety systems segment’s revenue share was the highest at over 28%. Airbags, keyless entry systems, electric power steering, electronic brake distribution, tyre pressure monitoring systems, electronic stability control and suspension control are just a few examples of the parts that make up safety systems. The safety systems market is expected to experience significant growth due to rising consumer awareness of technological developments affecting automotive safety equipment. The expanding applications and functionality that ADAS sensors provide are driving up demand for them at an exponential rate. An crucial component of ADAS are the sensors. From basic stereo cameras to the most recent LiDAR, sensors are used singly or in combination to carry out complex tasks. Thus, over the anticipated period, the demand for automotive electronic components is anticipated to be fueled by the rising popularity of automated driving.

In 2022, the OEM sector held the greatest share in automotive electronics market worldwide. Due to the improved durability and shelf-life of electronic components, the OEM sector dominated the market in 2022. Since they are an essential component of vehicles, people prefer to purchase electronic components from OEMs in order to get genuine parts. Additionally, a reduced revenue share for aftermarket electronic components is anticipated over the projected period due to the rise in design complexity of these electronic components. From 2023 to 2030, the aftermarket category is anticipated to experience a CAGR greater than 7.9%.

With a CAGR of more than 9.0%, the Asia Pacific automotive electronics industry is expected to maintain its leadership over the projection period, accounting for the greatest revenue share of 41.3% in 2022. Due to the thriving electronic component manufacturing operations, nations including Taiwan, South Korea, Malaysia, and Thailand have considerably contributed to the market expansion. China and Japan supply the majority of the automotive electronics demand in the Asia Pacific region. Presence of small number of automotive electronics producers does, however, present a lucrative investment opportunity for regional suppliers to take advantage of the domestic demand, making the rest of the Asia Pacific area a desirable location for investors.

Due to the high volume of automobile production and the presence of automotive electronic component producers such as TRW Automotive, Continental Corporation, Robert Bosch GmbH, and Autoliv, Inc., the North American automotive electronics market is anticipated to expand significantly over the course of the forecast period.

In 2022, Continental Corporation, Robert Bosch GmbH, Autoliv, Inc., Samsung, Delphi Technologies, Denso Corporation, and ZF Friedrichshafen AG were the major players that dominated the worldwide automotive electronics market. The majority of these businesses are concentrated on supplying technologically sophisticated and driven items to expand their range of offers. To expand in the market, the organisations are also engaging in strategic efforts such regional expansions, acquisitions, mergers, partnerships, and collaborations.

In order to generate new & creative items and broaden product offerings, product development and product launches continue to be the industry’s primary strategy for organic growth. For example, the Chinese government and the global technology giant ZF Group announced an investment deal in December 2022 for the development of a highly automated and intelligent factory in Guangzhou to produce cutting-edge electronics and driver assistance products. As a result, China will be able to produce more autonomous vehicles, cameras, sensors, and brake electronics.

- This report illustrates the most vital attributes of the Global Automotive Electronic Market, which are driving and providing opportunities.

- This research gives an in-depth analysis of the Global Automotive Electronic Market growth on the basis of several segments in the market.

- This report presents the predictions of the past and present trends of the Global Automotive Electronic Market.

- This study also presents the competitive analysis, such as key strategies and capabilities of major players of the Global Automotive Electronic Market.

Table Of Content

Chapter 1 Methodology & Scope

1.1 Market Segmentation & Scope

1.2 Market Definition

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 GVR’s Internal Database

1.3.3 Secondary Sources & Third Party Perspectives

1.3.4 Primary Research

1.4 Information Analysis

1.5 Market Formulation & Data Visualization

1.6 Data Validating & Publishing

Chapter 2 Executive Summary

2.1 Market Outlook

Chapter 3 Market Variables, Trends, & Scope

3.1 Penetration and Growth Prospect Mapping

3.2 Automotive Electronics- Value Chain Analysis

3.3 Automotive Electronics Market Dynamics

3.3.1 Market Drivers Analysis

3.3.2 Market Restraint Analysis

3.4 Automotive Electronics Industry Analysis – PESTLE

3.5 Automotive Electronics Industry Analysis – Porter’s

Chapter 4 Automotive Electronics Market: Component Estimates & Trend Analysis

4.1 Component Movement Analysis & Market Share, 2022 & 2030

4.2 Market Size & Forecasts and Trends Analysis, 2018 to 2030 for the following:

4.2.1 Electronic Control Unit

4.2.2 Sensors

4.2.3 Current Carrying Devices

4.2.4 Others

Chapter 5 Automotive Electronics Market: Application Estimates & Trend Analysis

5.1 Application Movement Analysis & Market Share, 2022 & 2030

5.2 Market Size & Forecasts and Trends Analysis, 2018 to 2030 for the following:

5.2.1 ADAS

5.2.2 Infotainment

5.2.3 Body Electronics

5.2.4 Safety Systems

5.2.5 Powertrain Electronics

Chapter 6 Automotive Electronics Market: Sales Channel Estimates & Trend Analysis

6.1 Sales Channel Movement Analysis & Market Share, 2022 & 2030

6.2 Market Size & Forecasts and Trends Analysis, 2018 to 2030 for the following:

6.2.1 OEM

6.2.2 Aftermarket

Chapter 7 Automotive Electronics Market: Regional Estimates & Trend Analysis

7.1 Regional Movement Analysis & Market Share, 2022 & 2030

7.2 Market Size & Forecasts and Trends Analysis, 2018 to 2030 for the following:

7.2.1 North America

7.2.1.1 U.S.

7.2.1.2 Canada

7.2.2 Europe

7.2.2.1 Germany

7.2.2.2 U.K.

7.2.3 Asia Pacific

7.2.3.1 China

7.2.3.2 Japan

7.2.3.3 India

7.2.4 Latin America

7.2.4.1 Brazil

7.2.4.2 Mexico

7.2.5 Middle East and Africa

7.2.5.1 UAE

7.2.5.2 Turkey

7.2.5.3 Saudi Arabia

7.2.5.4 South Africa

7.2.5.4 Rest of Middle East and Africa

Chapter 8 Competitive Landscape

8.1 Key Company Analysis, 2022

8.2 Company Profiles

8.2.1 CONTINENTAL AG

8.2.1.1 Company Overview

8.2.1.2 Financial Performance

8.2.1.3 Product Benchmarking

8.2.1.4 Strategic Initiatives

8.2.2 DENSO CORPORATION

8.2.2.1 Company Overview

8.2.2.2 Financial Performance

8.2.2.3 Product Benchmarking

8.2.2.4 Strategic Initiatives

8.2.3 Hella Gmbh & Co. Kgaa (Hella)

8.2.3.1 Company Overview

8.2.3.2 Financial Performance

8.2.3.3 Product Benchmarking

8.2.3.4 Strategic Initiatives

8.2.4 Infineon Technologies AG

8.2.4.1 Company Overview

8.2.4.2 Financial Performance

8.2.4.3 Product Benchmarking

8.2.4.4 Strategic Initiatives

8.2.5 Robert Bosch GmbH

8.2.5.1 Company Overview

8.2.5.2 Financial Performance

8.2.5.3 Product Benchmarking

8.2.5.4 Strategic Initiatives

8.2.6 Valeo Inc.

8.2.6.1 Company Overview

8.2.6.2 Financial Performance

8.2.6.3 Product Benchmarking

8.2.6.4 Strategic Initiatives

8.2.7 ZF Friedrichshafen AG

8.2.7.1 Company Overview

8.2.7.2 Financial Performance

8.2.7.3 Product Benchmarking

8.2.7.4 Strategic Initiatives

8.2.8 Hitachi Automotive Systems, Ltd.

8.2.8.1 Company Overview

8.2.8.2 Financial Performance

8.2.8.3 Product Benchmarking

8.2.8.4 Strategic Initiatives

8.2.9 Visteon Corporation

8.2.9.1 Company Overview

8.2.9.2 Financial Performance

8.2.9.3 Product Benchmarking

8.2.9.4 Strategic Initiatives

8.2.10 Xilinx, Inc.

8.2.10.1 Company Overview

8.2.10.2 Financial Performance

8.2.10.3 Product Benchmarking

8.2.10.4 Strategic Initiatives

List of Tables

Table 1 List of abbreviations

Table 2 Who supplies whom, 2020

Table 3 Electronic control unit market, 2018 – 2030 (USD Million)

Table 4 Sensors market, 2018 – 2030 (USD Million)

Table 5 Current carrying devices market, 2018 – 2030 (USD Million)

Table 6 Others market, 2018 – 2030 (USD Million)

Table 7 ADAS automotive electronics market, 2018 – 2030 (USD Million)

Table 8 Infotainment automotive electronics market, 2018 – 2030 (USD Million)

Table 9 Body electronics market, 2018 – 2030 (USD Million)

Table 10 Safety systems automotive electronics market, 2018 – 2030 (USD Million)

Table 11 Powertrain automotive electronics market, 2018 – 2030 (USD Million)

Table 12 OEM market, 2018 – 2030 (USD Million)

Table 13 Aftermarket, 2018 – 2030 (USD Million)

Table 14 North American automotive electronics market, by country, 2018 – 2030 (USD Million)

Table 15 North American automotive electronics market, by component, 2018 – 2030 (USD Million)

Table 16 North American automotive electronics market, by application, 2018 – 2030 (USD Million)

Table 17 North American automotive electronics, by sales channel, 2018 – 2030 (USD Million)

Table 18 U.S. automotive electronics market, by component, 2018 – 2030 (USD Million)

Table 19 U.S. automotive electronics market, by application, 2018 – 2030 (USD Million)

Table 20 U.S. automotive electronics, by sales channel, 2018 – 2030 (USD Million)

Table 21 Canada automotive electronics market, by component, 2018 – 2030 (USD Million)

Table 22 Canada automotive electronics market, by application, 2018 – 2030 (USD Million)

Table 23 Canada automotive electronics, by sales channel, 2018 – 2030 (USD Million)

Table 24 Europe automotive electronics market, by country, 2018 – 2030 (USD Million)

Table 25 Europe automotive electronics market, by component, 2018 – 2030 (USD Million)

Table 26 Europe automotive electronics market, by application, 2018 – 2030 (USD Million)

Table 27 Europe automotive electronics, by sales channel, 2018 – 2030 (USD Million)

Table 28 Germany automotive electronics market, by component, 2018 – 2030 (USD Million)

Table 29 Germany automotive electronics market, by application, 2018 – 2030 (USD Million)

Table 30 Germany automotive electronics, by sales channel, 2018 – 2030 (USD Million)

Table 31 U.K. automotive electronics market, by component, 2018 – 2030 (USD Million)

Table 32 U.K. automotive electronics market, by application, 2018 – 2030 (USD Million)

Table 33 U.K. automotive electronics, by sales channel, 2018 – 2030 (USD Million)

Table 34 Asia Pacific automotive electronics market, by country, 2018 – 2030 (USD Million)

Table 35 Asia Pacific automotive electronics market, by component, 2018 – 2030 (USD Million)

Table 36 Asia Pacific automotive electronics market, by application, 2018 – 2030 (USD Million)

Table 37 Asia Pacific automotive electronics, by sales channel, 2018 – 2030 (USD Million)

Table 38 China automotive electronics market, by component, 2018 – 2030 (USD Million)

Table 39 China automotive electronics market, by application, 2018 – 2030 (USD Million)

Table 40 China automotive electronics, by sales channel, 2018 – 2030 (USD Million)

Table 41 Japan automotive electronics market, by component, 2018 – 2030 (USD Million)

Table 42 Japan automotive electronics market, by application, 2018 – 2030 (USD Million)

Table 43 Japan automotive electronics, by sales channel, 2018 – 2030 (USD Million)

Table 44 India automotive electronics market, by component, 2018 – 2030 (USD Million)

Table 45 India automotive electronics market, by application, 2018 – 2030 (USD Million)

Table 46 India automotive electronics, by sales channel, 2018 – 2030 (USD Million)

Table 47 Latin American automotive electronics market, by country, 2018 – 2030 (USD Million)

Table 48 Latin American automotive electronics market, by component, 2018 – 2030 (USD Million)

Table 49 Latin American automotive electronics market, by application, 2018 – 2030 (USD Million)

Table 50 Latin American automotive electronics, by sales channel, 2018 – 2030 (USD Million)

Table 51 Brazil automotive electronics market, by component, 2018 – 2030 (USD Million)

Table 52 Brazil automotive electronics market, by application, 2018 – 2030 (USD Million)

Table 53 Brazil automotive electronics, by sales channel, 2018 – 2030 (USD Million)

Table 54 Mexico automotive electronics market, by component, 2018 – 2030 (USD Million)

Table 55 Mexico automotive electronics market, by application, 2018 – 2030 (USD Million)

Table 56 Mexico automotive electronics, by sales channel, 2018 – 2030 (USD Million)

Table 57 MEA automotive electronics market, by component, 2018 – 2030 (USD Million)

Table 58 MEA automotive electronics market, by application, 2018 – 2030 (USD Million)

Table 59 MEA automotive electronics, by sales channel, 2018 – 2030 (USD Million)

Table 51 UAE automotive electronics market, by component, 2018 – 2030 (USD Million)

Table 52 UAE automotive electronics market, by application, 2018 – 2030 (USD Million)

Table 53 UAE automotive electronics, by sales channel, 2018 – 2030 (USD Million)

Table 54 Turkey automotive electronics market, by component, 2018 – 2030 (USD Million)

Table 55 Turkey automotive electronics market, by application, 2018 – 2030 (USD Million)

Table 56 Turkey automotive electronics, by sales channel, 2018 – 2030 (USD Million)

Table 51 UAE automotive electronics market, by component, 2018 – 2030 (USD Million)

Table 52 UAE automotive electronics market, by application, 2018 – 2030 (USD Million)

Table 53 UAE automotive electronics, by sales channel, 2018 – 2030 (USD Million)

Table 54 Saudi Arabia automotive electronics market, by component, 2018 – 2030 (USD Million)

Table 55 Saudi Arabia automotive electronics market, by application, 2018 – 2030 (USD Million)

Table 56 Saudi Arabia automotive electronics, by sales channel, 2018 – 2030 (USD Million)

Table 54 South Africa automotive electronics market, by component, 2018 – 2030 (USD Million)

Table 55 South Africa automotive electronics market, by application, 2018 – 2030 (USD Million)

Table 56 South Africa automotive electronics, by sales channel, 2018 – 2030 (USD Million)

Table 54 Rest of Middle East and Africa automotive electronics market, by component, 2018 – 2030 (USD Million)

Table 55 Rest of Middle East and Africa automotive electronics market, by application, 2018 – 2030 (USD Million)

Table 56 Rest of Middle East and Africa automotive electronics, by sales channel, 2018 – 2030 (USD Million)