In order to gather qualitative and quantitative data for this report, a variety of sources from the supply and demand sides were interviewed throughout the main research phase. Industry professionals such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and other associated key executives from various important firms and organisations participating in the global clinical workflow solutions market are the main sources on the supply side. The demand side’s principal sources included professionals in the field, including physicians, nurses, and hospital buy managers.

To verify the market segmentation, identify important market participants, and obtain information on important market dynamics and industry trends, primary research was carried out.

Clinical workflow solutions are instruments that facilitate improved workflows and collaboration in clinics and hospitals, so helping to improve coordination between doctors or surgeons, nurses or other staff, and patients. Moreover, analytics and surveillance are employed to efficiently monitor the workflow. Clinical workflow solutions allow hospital departments to collaborate and coordinate their efforts to provide patients with appropriate safety and care. The advantages of these systems include enhanced flexibility for process optimisation, increased transparency, data cross-marching, a positive experience for both patients and staff, and different reimbursement levels. They are also useful for managing and storing enormous amounts of medical data, which are growing daily.

Research Methodology:

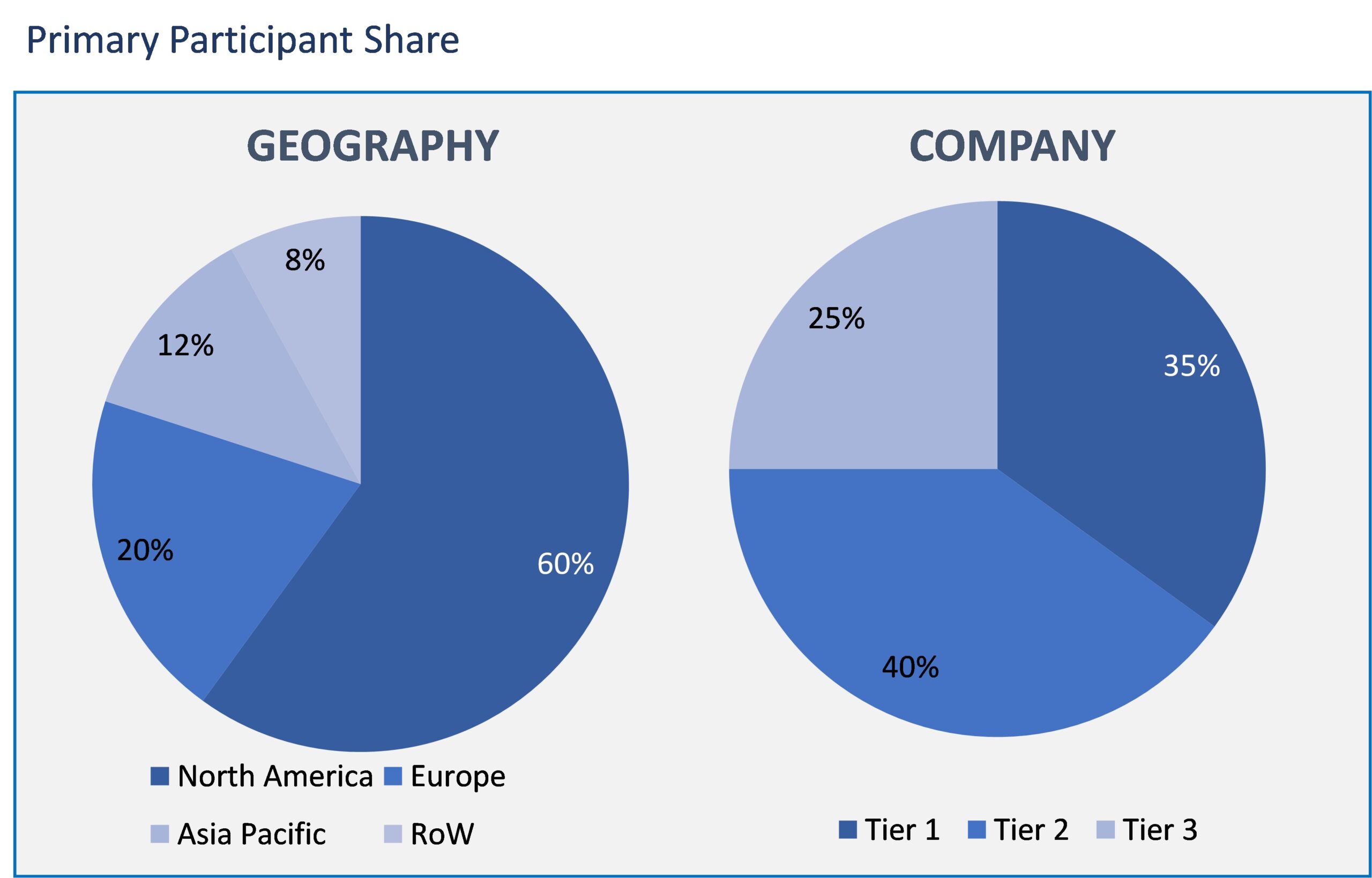

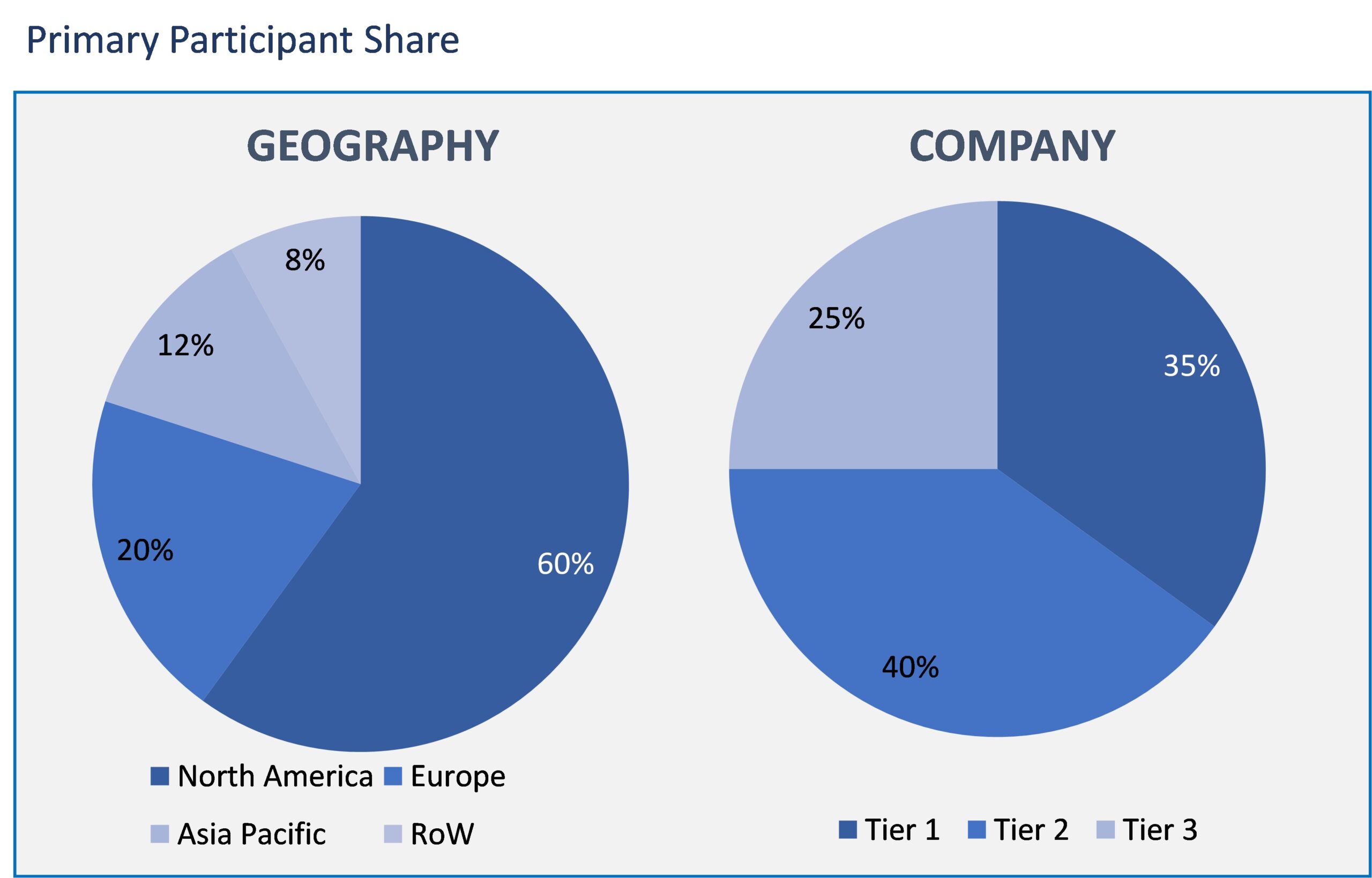

After secondary research provided a fundamental understanding of the worldwide Clinical Workflow Solutions Market scenario, extensive primary research was carried out. A number of primary interviews were carried out with industry experts from the supply and demand sides, including C- and D-level executives, product managers, and marketing and sales managers of major manufacturers, distributors, and channel partners from tier 1 and tier 2 companies offering Autologous Stem Cell and Non-Stem Cell Based Therapies Market, as well as personnel from academia, research, and CROs. These interviews were conducted across five major regions: North America, Europe, Asia Pacific, and the Rest of the World (Latin America & the Middle East & Africa). Participants from the supply-side and demand-side participated in about 70% and 30% of the primary interviews, respectively. Through the use of questionnaires, emails, online surveys, in-person interviews, and phone interviews, this main data was gathered. The primary participants share is given below:

Clinical Workflow Solutions Market based on Product:

- Data Integration

- Real-time Communication Solutions

- Workflow Automation Solutions

- Care Collaboration Solutions

- Enterprise Reporting & Analytics Solutions

Clinical Workflow Solutions Market based on End user:

- Hospitals

- Long-term care facilities

- Ambulatory care Centers

Clinical Workflow Solutions Market based on Geography:

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe (RoE)

- Asia Pacific (APAC)

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific (RoAPAC)

- Latin America (LATAM)

- Brazil

- Argentina

- Rest of South America

- Middle East and Africa (MEA)

- UAE

- Turkey

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

Clinical workflow solutions are software programmes that, through merging imaging silos, optimising workflows, and fostering cooperation, help to improve diagnostic confidence. Furthermore, these workflow solutions help with process monitoring by providing analytics and surveillance reports. The clinical workflow solutions market is divided into four segments: end users (hospitals, long-term care facilities, ambulatory care centres), type (data integration solutions, real-time communication systems, workflow automation solutions, care collaboration solutions, and enterprise reporting and analytics solutions), and geography (North America, Europe, Asia-Pacific, Middle-East and Africa, and South America). The study also includes projected market volumes and trends for 17 nations in key international areas. The report provides the above segments’ respective values (in USD million).

The significance of clinical workflow solutions has grown among healthcare organisations looking for more effective, appealing, and impactful approaches to enhance patient outcomes and safety. This is so that continuous monitoring and better treatment decisions may be made thanks to the real-time health data flow that these technologies facilitate. In the upcoming years, there is anticipated to be a rise in the adoption of clinical workflow solutions, which include features to help enhance care quality, care coordination, and overall patient happiness while lowering the rate of prescription errors and adverse drug events.

Hospitals that struggle with inadequate interoperability usually create or licence interfaces to import and export data from internal and external sources, including medical devices, the hospital’s EHR, laboratories, admit/discharge/transfer, and outside laboratories. As a result, a single hospital might use a few dozen interfaces, whereas a big health system with numerous locations might need to use thousands or even hundreds of interfaces. In addition, hospitals using health information exchanges as a means of achieving interoperability face a number of obstacles, including both financial and operational difficulties. One of the main things holding back the demand for clinical workflow solutions is this.

The prominent players in the global clinical workflow solutions market Hill-Rom Holdings, Inc. (US), Ascom Holding AG (Switzerland), Koninklijke Philips N.V. (Netherlands), Cerner Corporation (US), Cisco Systems, Inc. (US), Stanley Black & Decker, Inc. (US), GE Healthcare (US), Epic Systems Corporation (US), Infor, Inc. (US), Allscripts Healthcare Solutions, Inc. (US), Spok, Inc. (US), Vocera Communications, Inc. (US), Capsule Technologies, Inc. (US), AMETEK, Inc. (US), NextGen Healthcare (US), Azure Healthcare Limited (Australia), Getinge Group (Sweden), Change Healthcare (US), athenahealth (US), Sonitor Technologies, Inc. (Norway), and Connexall (Canada).

- This report illustrates the most vital attributes of the Clinical Workflow Solutions Market, which are driving and providing opportunities.

- This research gives an in-depth analysis of the Clinical Workflow Solutions Market growth on the basis of several segments in the market.

- This report presents the predictions of the past and present trends of the Clinical Workflow Solutions Market.

- This study also presents the competitive analysis, such as key strategies and capabilities of major players of the Clinical Workflow Solutions Market.

List of Tables

TABLE 1. CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY PRODUCT, 2021-2030 (USD BILLION)

TABLE 2. CLINICAL WORKFLOW SOLUTIONS MARKET VALUE FOR DATA INTEGRATION, BY GEOGRAPHY , 2021-2030 (USD BILLION)

TABLE 3. CLINICAL WORKFLOW SOLUTIONS MARKET VALUE FOR REAL-TIME COMMUNICATION SOLUTIONS, BY GEOGRAPHY, 2021-2030 (USD BILLION)

TABLE 4. CLINICAL WORKFLOW SOLUTIONS MARKET VALUE FOR WORKFLOW AUTOMATION SOLUTIONS, BY GEOGRAPHY, 2021-2030 (USD BILLION)

TABLE 5. CLINICAL WORKFLOW SOLUTIONS MARKET VALUE FOR CARE COLLABORATION SOLUTIONS, BY GEOGRAPHY, 2021-2030 (USD BILLION)

TABLE 6. CLINICAL WORKFLOW SOLUTIONS MARKET VALUE FOR ENTERPRISE REPORTING & ANALYTICS SOLUTIONS, BY GEOGRAPHY, 2021-2030 (USD BILLION)

TABLE 7. CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY END USER, 2021-2030 (USD BILLION)

TABLE 8. CLINICAL WORKFLOW SOLUTIONS MARKET VALUE FOR HOSPITALS, 2021-2030 (USD BILLION)

TABLE 9. CLINICAL WORKFLOW SOLUTIONS MARKET VALUE FOR LONG-TERM CARE FACILITIES, BY GEOGRAPHY, 2021-2030 (USD BILLION)

TABLE 10. CLINICAL WORKFLOW SOLUTIONS MARKET VALUE FOR AMBULATORY CARE CENTERS, BY GEOGRAPHY, 2021-2030 (USD BILLION)

TABLE 11. NORTH AMERICA CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY COUNTRY, 2021-2030 (USD BILLION)

TABLE 12. NORTH AMERICA CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY PRODUCT, 2021-2030 (USD BILLION)

TABLE 13. NORTH AMERICA CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY END USER, 2021-2030 (USD BILLION)

TABLE 14. U.S CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY PRODUCT, 2021-2030 (USD BILLION)

TABLE 15. U.S CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY END USER, 2021-2030 (USD BILLION)

TABLE 16. CANADA CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY PRODUCT, 2021-2030 (USD BILLION)

TABLE 17. CANADA CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY END USER, 2021-2030 (USD BILLION)

TABLE 18. MEXICO CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY PRODUCT, 2021-2030 (USD BILLION)

TABLE 19. MEXICO CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY END USER, 2021-2030 (USD BILLION)

TABLE 20. EUROPE CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY COUNTRY, 2021-2030 (USD BILLION)

TABLE 21. EUROPE CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY PRODUCT, 2021-2030 (USD BILLION)

TABLE 22. EUROPE CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY END USER, 2021-2030 (USD BILLION)

TABLE 23. GERMANY CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY PRODUCT, 2021-2030 (USD BILLION)

TABLE 24. GERMANY CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY END USER, 2021-2030 (USD BILLION)

TABLE 25. U.K CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY PRODUCT, 2021-2030 (USD BILLION)

TABLE 26. U.K CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY END USER, 2021-2030 (USD BILLION)

TABLE 27. FRANCE CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY PRODUCT, 2021-2030 (USD BILLION)

TABLE 28. FRANCE CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY END USER, 2021-2030 (USD BILLION)

TABLE 29. ITALY CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY PRODUCT, 2021-2030 (USD BILLION)

TABLE 30. ITALY CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY END USER, 2021-2030 (USD BILLION)

TABLE 31. SPAIN CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY PRODUCT, 2021-2030 (USD BILLION)

TABLE 32. SPAIN CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY END USER, 2021-2030 (USD BILLION)

TABLE 33. ROE CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY PRODUCT, 2021-2030 (USD BILLION)

TABLE 34. ROE CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY END USER, 2021-2030 (USD BILLION)

TABLE 35. ASIA PACIFIC CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY COUNTRY, 2021-2030 (USD BILLION)

TABLE 36. ASIA PACIFIC CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY PRODUCT, 2021-2030 (USD BILLION)

TABLE 37. ASIA PACIFIC CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY END USER, 2021-2030 (USD BILLION)

TABLE 38. CHINA CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY PRODUCT, 2021-2030 (USD BILLION)

TABLE 39. CHINA CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY END USER, 2021-2030 (USD BILLION)

TABLE 40. INDIA CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY PRODUCT, 2021-2030 (USD BILLION)

TABLE 41. INDIA CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY END USER, 2021-2030 (USD BILLION)

TABLE 42. JAPAN CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY PRODUCT, 2021-2030 (USD BILLION)

TABLE 43. JAPAN CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY END USER, 2021-2030 (USD BILLION)

TABLE 44. REST OF APAC CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY PRODUCT, 2021-2030 (USD BILLION)

TABLE 45. REST OF APAC CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY END USER, 2021-2030 (USD BILLION)

TABLE 46. LATIN AMERICA CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY PRODUCT, 2021-2030 (USD BILLION)

TABLE 47. LATIN AMERICA CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY END USER, 2021-2030 (USD BILLION)

TABLE 48. BRAZIL CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY PRODUCT, 2021-2030 (USD BILLION)

TABLE 49. BRAZIL CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY END USER, 2021-2030 (USD BILLION)

TABLE 50. ARGENTINA CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY PRODUCT, 2021-2030 (USD BILLION)

TABLE 51. ARGENTINA CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY END USER, 2021-2030 (USD BILLION)

TABLE 52. MIDDLE EAST AND AFRICA CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY TYPE, 2021-2030 (USD BILLION)

TABLE 53. MIDDLE EAST AND AFRICA CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY PRODUCT, 2021-2030 (USD BILLION)

TABLE 54. MIDDLE EAST AND AFRICA CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY END USER, 2021-2030 (USD BILLION)

TABLE 55. SAUDI ARABIA CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY PRODUCT, 2021-2030 (USD BILLION)

TABLE 56. SAUDI ARABIA CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY END USER, 2021-2030 (USD BILLION)

TABLE 57. UAE CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY PRODUCT, 2021-2030 (USD BILLION)

TABLE 58. UAE CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY END USER, 2021-2030 (USD BILLION)

TABLE 59. REST OF MIDDLE EAST AND AFRICA CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY PRODUCT, 2021-2030 (USD BILLION)

TABLE 60. REST OF MIDDLE EAST AND AFRICA CLINICAL WORKFLOW SOLUTIONS MARKET VALUE, BY END USER, 2021-2030 (USD BILLION)

TABLE 61. CERNER CORPORATION: FINANCIALS

TABLE 62. CERNER CORPORATION: PRODUCTS & SERVICES

TABLE 63. CERNER CORPORATION: RECENT DEVELOPMENTS

TABLE 64. ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.: FINANCIALS

TABLE 65. ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.: PRODUCTS & SERVICES

TABLE 66. ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.: RECENT DEVELOPMENTS

TABLE 67. NXGN MANAGEMENT, LLC: FINANCIALS

TABLE 68. NXGN MANAGEMENT, LLC: PRODUCTS & SERVICES

TABLE 69. NXGN MANAGEMENT, LLC: RECENT DEVELOPMENTS

TABLE 70. KONINKLIJKE PHILIPS N.V.: FINANCIALS

TABLE 71. KONINKLIJKE PHILIPS N.V.: PRODUCTS & SERVICES

TABLE 72. KONINKLIJKE PHILIPS N.V.: RECENT DEVELOPMENTS

TABLE 73. MCKESSON CORPORATION: FINANCIALS

TABLE 74. MCKESSON CORPORATION: PRODUCTS & SERVICES

TABLE 75. MCKESSON CORPORATION: RECENT DEVELOPMENTS

TABLE 76. HILL-ROM SERVICES INC.: FINANCIALS

TABLE 77. HILL-ROM SERVICES INC.: PRODUCTS & SERVICES

TABLE 78. HILL-ROM SERVICES INC.: RECENT DEVELOPMENTS

TABLE 79. GENERAL ELECTRIC: FINANCIALS

TABLE 80. GENERAL ELECTRIC: PRODUCTS & SERVICES

TABLE 81. GENERAL ELECTRIC: DEVELOPMENTS

TABLE 82. CISCO: FINANCIALS

TABLE 83. CISCO: PRODUCTS & SERVICES

TABLE 84. CISCO: RECENT DEVELOPMENTS

TABLE 85. STANLY HEALTHCARE: FINANCIALS

TABLE 86. STANLY HEALTHCARE: PRODUCTS & SERVICES

TABLE 87. STANLY HEALTHCARE: RECENT DEVELOPMENTS

TABLE 88. ASCOM: FINANCIALS

TABLE 89. ASCOM: PRODUCTS & SERVICES

TABLE 90. ASCOM: RECENT DEVELOPMENTS