Currently, the industry is switching from outdated “electric drive” designs to fully hybrid and all-electric vehicles. Along with automation, ultra-precision agriculture, political changes, and demographic pressures, electrification is also influencing these fields. Furthermore, the off-highway electric vehicle market in developed countries is being driven by quick infrastructure development and updated government regulations related to construction operations. For example, SANY Group unveiled the electric version of its truck mixers in August 2020. It includes features like 350 kW permanent magnet synchronous motors, high-energy-density lithium iron phosphate batteries, and contemporary monitoring features like real-time monitoring, performance analysis, and remote diagnosis.

The market for off-highway electric vehicles is expanding as a result of reasons such the rising popularity of adventure sports and leisure activities, the demand for electric gear in the construction industry, and rising electric vehicle sales. The industry is likely to have slow growth due to restrictions on ATV and UTV use in wildlife areas and the high maintenance costs of off-highway electric vehicles. Additionally, the leading players in the off-highway EV market have access to new markets due to technological advancements in these vehicles and the establishment of dealer networks for effective product distribution.

The off-highway electric vehicle market is divided into segments based on the type of vehicle, battery type, energy storage capacity, use, and geography. The market is split into battery electric vehicles (BEV) and hybrid electric vehicles (HEV) based on the kind of vehicle. It is divided into three categories based on energy storage capacity: 50 kWh, 50-“200 kWh, and >200 kWh. There are two types of batteries: lithium-ion (Li-Ion) and lead-acid. It is further divided into construction, agricultural, mining, and other categories based on application. It is examined across North America, Europe, Asia-Pacific, and LAMEA in terms of regions.

Research Methodology:

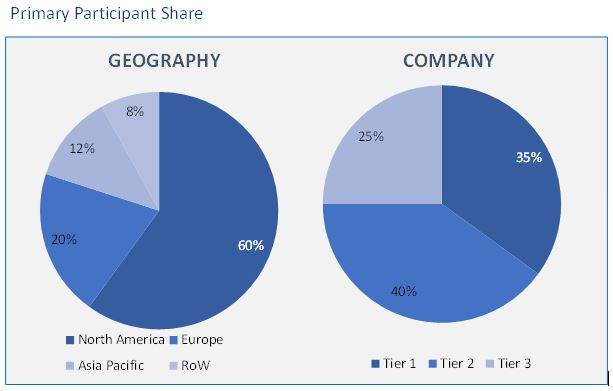

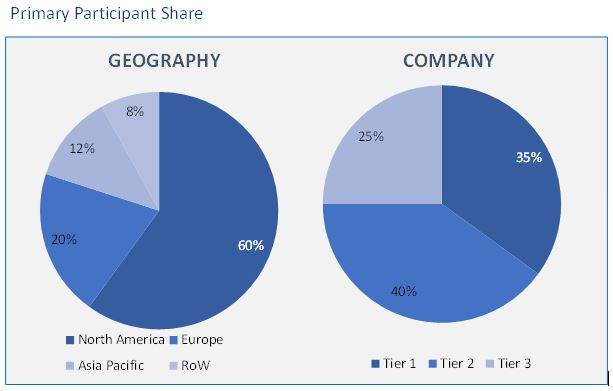

Our study offers precise data insights by utilising the most recent research techniques. Our professionals provide the top study papers with suggestions for producing income. Both top-down and bottom-up research techniques are used by analysts to do thorough study. This facilitates investigating the market from many angles. This further aids market analysts in dividing up the many market segments for individual analysis. To investigate various market segments, we employ data triangulation methodologies. By doing this, we make sure that every client of ours receives accurate market information. The primary participants share is given below:

Off-highway Electric Vehicle Market based on Application:

- Construction

- Agriculture

- Mining

Off-highway Electric Vehicle Market based on Propulsion:

- Battery Electric Vehicle (BEV)

- Hybrid Electric Vehicle (HEV)

Off-highway Electric Vehicle Market based on Storage:

Off-highway Electric Vehicle Market based on Geography:

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe (RoE)

- Asia Pacific (APAC)

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific (RoAPAC)

- Latin America (LATAM)

- Brazil

- Argentina

- Rest of South America

- Middle East and Africa (MEA)

- UAE

- Turkey

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

In 2022, the global market for off-highway electric vehicles saw the biggest revenue share, or around 24%, go to the agricultural sector. Electric tractors and harvesters are featured in this segment. Consumers in North America and Europe are employing modern farm equipment and cutting-edge agricultural practises to improve yields. Automation can be used in conjunction with the electrification of farming equipment to assist address labour shortages and free up workers’ attention for other crucial duties.

During the projection period, the construction segment is expected to post a CAGR of 20.4%. The section features electric excavators and loaders as well as other construction machinery. One of the main factors fueling the segment’s expansion and, ultimately, the market’s growth, is the rising amount of money that governments around the world are investing in the construction of public infrastructure. The construction industry is concentrating on electrifying smaller pieces of machinery. Due to their lower power requirements, battery technology and electric propulsion are well suited for smaller devices.

By 2022, the Hybrid Electric Vehicle (HEV) sector had the greatest revenue share (56%), and from 2023 to 2030, it is expected to rule the market. The internal combustion engine will be used more frequently in conjunction with the electric drivetrain in a hybrid electric car. Due to the tight emission regulations established by regulatory organisations like the U.S. EPA and the European Commission, there is a greater demand for off-highway equipment with hybrid propulsion. This has encouraged automakers to design off-road vehicles that are environmentally friendly.

Off-highway vehicle producers have started using hybrid engines with diesel-electric power systems as of 2017. With the help of these diesel-electric hybrid drive systems, users can run a smaller engine at a lower rpm, resulting in less part movement and high fuel efficiency. All of these elements are anticipated to boost the expansion of the off-highway electric vehicle sector, particularly the hybrid electric vehicle segment.

North America had the biggest revenue share of 25.4% in 2022, and it is expected that this dominance would persist throughout the projected period. The expansion can be attributable to the existence of important businesses in North America as Deere & Company, CNH Industrial N.V., and Caterpillar. Additionally, the expansion of the local construction sector is boosting demand for off-highway electric machinery.

To reduce hazardous emissions, the U.S. has put in place severe laws. The United States Environment Protection Agency (EPA) estimates that in 2018, off-road vehicles and equipment contributed close to 30% of all greenhouse gas emissions. Companies have released electric versions of their off-highway vehicles on the market in response to rising GHG emissions.

- This report illustrates the most vital attributes of the Off-highway Electric Vehicle Market, which are driving and providing opportunities.

- This research gives an in-depth analysis of the Off-highway Electric Vehicle Market growth on the basis of several segments in the market.

- This report presents the predictions of the past and present trends of the Off-highway Electric Vehicle Market.

- This study also presents the competitive analysis, such as key strategies and capabilities of major players of the Off-highway Electric Vehicle Market.

List of Tables

TABLE 1. OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY APPLICATION, 2021-2030 (USD BILLION)

TABLE 2. OFF-HIGHWAY ELECTRIC VEHICLE MARKET FOR CONSTRUCTION, BY GEOGRAPHY, 2021-2030 (USD BILLION)

TABLE 3. OFF-HIGHWAY ELECTRIC VEHICLE MARKET FOR AGRICULTURE, BY GEOGRAPHY, 2021-2030 (USD BILLION)

TABLE 4. OFF-HIGHWAY ELECTRIC VEHICLE MARKET FOR MINING, BY GEOGRAPHY, 2021-2030 (USD BILLION)

TABLE 5. OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2030 (USD BILLION)

TABLE 6. OFF-HIGHWAY ELECTRIC VEHICLE MARKET FOR BATTERY ELECTRIC VEHICLE (BEV), 2021-2030 (USD BILLION)

TABLE 7. OFF-HIGHWAY ELECTRIC VEHICLE MARKET FOR HYBRID ELECTRIC VEHICLE (BEV), BY GEOGRAPHY, 2021-2030 (USD BILLION)

TABLE 8. OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY STORAGE, 2021-2030 (USD BILLION)

TABLE 9. OFF-HIGHWAY ELECTRIC VEHICLE MARKET FOR LI-ION, 2021-2030 (USD BILLION)

TABLE 10. OFF-HIGHWAY ELECTRIC VEHICLE MARKET FOR LEAD ACID, 2021-2030 (USD BILLION)

TABLE 11. NORTH AMERICA OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY COUNTRY, 2021-2030 (USD BILLION)

TABLE 12. NORTH AMERICA OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY APPLICATION, 2021-2030 (USD BILLION)

TABLE 13. NORTH AMERICA OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2030 (USD BILLION)

TABLE 14. NORTH AMERICA OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY STORAGE, 2021-2030 (USD BILLION)

TABLE 15. U.S OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY APPLICATION, 2021-2030 (USD BILLION)

TABLE 16. U.S OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2030 (USD BILLION)

TABLE 17. U.S OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY STORAGE, 2021-2030 (USD BILLION)

TABLE 18. CANADA OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY APPLICATION, 2021-2030 (USD BILLION)

TABLE 19. CANADA OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2030 (USD BILLION)

TABLE 20. CANADA OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY STORAGE, 2021-2030 (USD BILLION)

TABLE 21. MEXICO OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY APPLICATION, 2021-2030 (USD BILLION)

TABLE 22. MEXICO OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2030 (USD BILLION)

TABLE 23. MEXICO OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY STORAGE, 2021-2030 (USD BILLION)

TABLE 24. EUROPE OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY COUNTRY, 2021-2030 (USD BILLION)

TABLE 25. EUROPE OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY APPLICATION, 2021-2030 (USD BILLION)

TABLE 26. EUROPE OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2030 (USD BILLION)

TABLE 27. EUROPE OFF-HIGHWAY ELECTRIC VEHICLE MARKET, RANGE, 2021-2030 (USD BILLION)

TABLE 28. GERMANY OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY APPLICATION, 2021-2030 (USD BILLION)

TABLE 29. GERMANY OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2030 (USD BILLION)

TABLE 30. GERMANY OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY STORAGE, 2021-2030 (USD BILLION)

TABLE 31. U.K OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY APPLICATION, 2021-2030 (USD BILLION)

TABLE 32. U.K OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2030 (USD BILLION)

TABLE 33. U.K OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY STORAGE, 2021-2030 (USD BILLION)

TABLE 34. FRANCE OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY APPLICATION, 2021-2030 (USD BILLION)

TABLE 35. FRANCE OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2030 (USD BILLION)

TABLE 36. FRANCE OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY STORAGE, 2021-2030 (USD BILLION)

TABLE 37. ITALY OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY APPLICATION, 2021-2030 (USD BILLION)

TABLE 38. ITALY OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2030 (USD BILLION)

TABLE 39. ITALY OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY STORAGE, 2021-2030 (USD BILLION)

TABLE 40. SPAIN OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY APPLICATION, 2021-2030 (USD BILLION)

TABLE 41. SPAIN OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2030 (USD BILLION)

TABLE 42. SPAIN OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY STORAGE, 2021-2030 (USD BILLION)

TABLE 43. ROE OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY APPLICATION, 2021-2030 (USD BILLION)

TABLE 44. ROE OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2030 (USD BILLION)

TABLE 45. ROE OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY STORAGE, 2021-2030 (USD BILLION)

TABLE 46. ASIA PACIFIC OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY COUNTRY, 2021-2030 (USD BILLION)

TABLE 47. ASIA PACIFIC OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY APPLICATION, 2021-2030 (USD BILLION)

TABLE 48. ASIA PACIFIC OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2030 (USD BILLION)

TABLE 49. ASIA PACIFIC OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY STORAGE, 2021-2030 (USD BILLION)

TABLE 50. CHINA OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY APPLICATION, 2021-2030 (USD BILLION)

TABLE 51. CHINA OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2030 (USD BILLION)

TABLE 52. CHINA OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY STORAGE, 2021-2030 (USD BILLION)

TABLE 53. INDIA OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY APPLICATION, 2021-2030 (USD BILLION)

TABLE 54. INDIA OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2030 (USD BILLION)

TABLE 55. INDIA OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY STORAGE, 2021-2030 (USD BILLION)

TABLE 56. JAPAN OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY APPLICATION, 2021-2030 (USD BILLION)

TABLE 57. JAPAN OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2030 (USD BILLION)

TABLE 58. JAPAN OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY STORAGE, 2021-2030 (USD BILLION)

TABLE 59. REST OF APAC OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY APPLICATION, 2021-2030 (USD BILLION)

TABLE 60. REST OF APAC OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2030 (USD BILLION)

TABLE 61. REST OF APAC OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY STORAGE, 2021-2030 (USD BILLION)

TABLE 62. LATIN AMERICA OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY APPLICATION, 2021-2030 (USD BILLION)

TABLE 63. LATIN AMERICA OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2030 (USD BILLION)

TABLE 64. LATIN AMERICA OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY STORAGE, 2021-2030 (USD BILLION)

TABLE 65. BRAZIL OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY APPLICATION, 2021-2030 (USD BILLION)

TABLE 66. BRAZIL OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2030 (USD BILLION)

TABLE 67. BRAZIL OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY STORAGE, 2021-2030 (USD BILLION)

TABLE 68. ARGENTINA OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY APPLICATION, 2021-2030 (USD BILLION)

TABLE 69. ARGENTINA OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2030 (USD BILLION)

TABLE 70. ARGENTINA OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY STORAGE, 2021-2030 (USD BILLION)

TABLE 71. MIDDLE EAST AND AFRICA OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY APPLICATION, 2021-2030 (USD BILLION)

TABLE 72. MIDDLE EAST AND AFRICA OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2030 (USD BILLION)

TABLE 73. MIDDLE EAST AND AFRICA OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY STORAGE, 2021-2030 (USD BILLION)

TABLE 74. SAUDI ARABIA OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY APPLICATION, 2021-2030 (USD BILLION)

TABLE 75. SAUDI ARABIA OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2030 (USD BILLION)

TABLE 76. SAUDI ARABIA OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY STORAGE, 2021-2030 (USD BILLION)

TABLE 77. UAE OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY APPLICATION, 2021-2030 (USD BILLION)

TABLE 78. UAE OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2030 (USD BILLION)

TABLE 79. UAE OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY STORAGE, 2021-2030 (USD BILLION)

TABLE 80. REST OF MIDDLE EAST AND AFRICA OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY APPLICATION, 2021-2030 (USD BILLION)

TABLE 81. REST OF MIDDLE EAST AND AFRICA OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2030 (USD BILLION)

TABLE 82. REST OF MIDDLE EAST AND AFRICA OFF-HIGHWAY ELECTRIC VEHICLE MARKET, BY STORAGE, 2021-2030 (USD BILLION)

TABLE 83. CATERPILLAR: FINANCIALS

TABLE 84. CATERPILLAR: PRODUCTS & SERVICES

TABLE 85. CATERPILLAR: RECENT DEVELOPMENTS

TABLE 86. VOLVO CONSTRUCTION EQUIPMENT AB: FINANCIALS

TABLE 87. VOLVO CONSTRUCTION EQUIPMENT AB: PRODUCTS & SERVICES

TABLE 88. VOLVO CONSTRUCTION EQUIPMENT AB: RECENT DEVELOPMENTS

TABLE 89. KOMATSU LTD.: FINANCIALS

TABLE 90. KOMATSU LTD.: PRODUCTS & SERVICES

TABLE 91. KOMATSU LTD.: RECENT DEVELOPMENTS

TABLE 92. DEERE & COMPANY: FINANCIALS

TABLE 93. DEERE & COMPANY: PRODUCTS & SERVICES

TABLE 94. DEERE & COMPANY: RECENT DEVELOPMENTS

TABLE 95. SANDVIK AB: FINANCIALS

TABLE 96. SANDVIK AB: PRODUCTS & SERVICES

TABLE 97. SANDVIK AB: RECENT DEVELOPMENTS

TABLE 98. HITACHI CONSTRUCTION MACHINERY CO., LTD.: FINANCIALS

TABLE 99. HITACHI CONSTRUCTION MACHINERY CO., LTD.: PRODUCTS & SERVICES

TABLE 100. HITACHI CONSTRUCTION MACHINERY CO., LTD.: RECENT DEVELOPMENTS

TABLE 101. EPIROC AB: FINANCIALS

TABLE 102. EPIROC AB: PRODUCTS & SERVICES

TABLE 103. EPIROC AB: RECENT DEVELOPMENTS

TABLE 104. DOOSAN CORPORATION: FINANCIALS

TABLE 105. DOOSAN CORPORATION: PRODUCTS & SERVICES

TABLE 106. DOOSAN CORPORATION: RECENT DEVELOPMENTS

TABLE 107. J C BAMFORD EXCAVATORS LTD.: FINANCIALS

TABLE 108. J C BAMFORD EXCAVATORS LTD.: PRODUCTS & SERVICES

TABLE 109. J C BAMFORD EXCAVATORS LTD.: RECENT DEVELOPMENTS

TABLE 110. CNH INDUSTRIAL N.V.: FINANCIALS

TABLE 111. CNH INDUSTRIAL N.V.: PRODUCTS & SERVICES

TABLE 112. CNH INDUSTRIAL N.V.: RECENT DEVELOPMENTS